The low carbon fuel standard (LCFS) programs in California and Oregon offer a significant sales tool for OEMs and dealers by educating fleets on how to reduce the upfront costs of EVs. In the previous article, “Generate Revenue with Clean Fuels,” the LCFS program is explained in more detail. In brief, LCFS works as a market system where users and producers of clean energy earn credits through their emission reductions.

As more medium- and heavy-duty electric vehicles (EVs) come to market, vehicle manufacturers and dealers will be faced with the challenge of how to sell electric vehicles that are more expensive than competing diesel- or natural gas-fueled models. Any money that can help customers lower total cost of ownership (TCO) for EVs will help move fleets closer to the purchase decision.

Compared to other vehicle technologies on the market, EVs present a greater revenue opportunity for fleets under LCFS. This is due to the increased operational efficiency and reduced emissions of EVs, as well as, how the LCFS program is setup to administer credits.

LCFS works as a market system where users and producers of clean energy earn credits through their emission reductions.

Earning Potential for EVs

The LCFS program sets parameters around how each technology can earn and sell credits. Under most circumstances, the credits earned by the displacement of emissions using clean vehicle technology go to the producer or provider of the fuel. Which means, for non-electric vehicles, fleets cannot directly earn the credits, and therefore the revenue.

Electric fleets have more opportunity under LCFS because they are most likely to own the charging infrastructure, meaning they are entitled to the credits. The revenue from selling the credits can be used to offset the cost of the new EVs, charging infrastructure, and the electricity itself. Fleets can accrue credits directly using several electric vehicle and equipment types, including Class 8 tractors, delivery vans, forklifts, electric transportation refrigeration units (eTRUs), cargo handling equipment, and more.

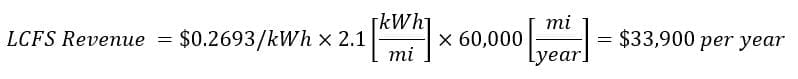

A quick look at the numbers immediately reveals the potential for LCFS to buy down the high up-front costs of EVs. A fleet running an electric Class 8 tractor driving 60,000 miles annually has the potential to generate credits worth $33,900 per year, while a Class 6 electric truck that drives 20,000 miles annually has the potential to generate $7,000 in credits per year.

Fleets can accrue credits using several EV and equipment types, including Class 8 tractors, delivery vans, forklifts, eTRUs, cargo handling equipment, and more.

By educating fleets on the potential with LCFS, vehicle OEMs and dealers can use this revenue stream as a key part of the selling strategy for electric vehicles to help the customer move toward the purchase decision. An important part of that education is understanding how the higher efficiency of EVs leads to more revenue going to the fleet’s bottom line.

Why EVs are More Efficient and Environmentally Friendly

EVs are more efficient than their diesel counterparts when converting fuel into mechanical power due to a reduction in thermal power losses from the drivetrain, and the energy gained from regenerative braking.

First, the thermal losses, or wasted heat energy, in internal combustion engines only allow 30 to 45% of the fuel energy to be used for effective power at the wheels. In comparison, electric drivetrains are roughly 90% efficient in converting battery stored electricity into power at the wheels.

Second, electric drivetrains include regenerative braking to recapture energy expended from stopping the vehicle, which is not possible in traditional internal combustion engine drivetrains. This boosts efficiency significantly for electric heavy-duty applications, since low-speed, urban driving with a lot of braking makes up a major portion of a typical truck route.

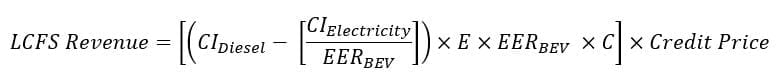

The LCFS program uses a core equation taking into account the efficiency and carbon intensity of each fuel technology to determine the credits earned.

The efficiency gained by both elements results in improved reduction of greenhouse gas (GHG) emissions. Even when using typical non-renewable grid electricity, EVs still contribute less GHG emissions well-to-wheel than diesel vehicles.

Calculating LCFS Revenue Potential

To determine the revenue potential for a fleet, you’ll first need to understand how the amount of LCFS credits are calculated. The LCFS program uses a core equation taking into account the efficiency and carbon intensity of each fuel technology to determine the credits earned.

The Energy Economy Ratio (EER) is CARB’s estimate of the efficiency of vehicles – this number represents the effectiveness of a fuel used in a powertrain as compared to a reference fuel (e.g., diesel) used in the same powertrain. Based on the reasons explained above, the CARB LCFS program considers battery electric vehicles (BEVs) to be five times more energy efficient than equivalent diesel vehicles, or 5.0 EER.

The CI, or carbon intensity, is defined for each fuel technology as the comprehensive well-to-wheel analysis of that fuel’s GHG emissions. The CI value for diesel is a benchmark that declines over time, thus forcing petroleum fuel producers to reduce their CI annually or buy credits. The CI value for California grid electricity is a value from CARB updated periodically to reflect the grid’s GHG emissions, and could potentially reach as low as zero when using 100% renewable electricity.

Next, E is the actual amount of fuel energy consumed in a year, in units of megajoules (MJ), which are typically converted to kilowatt-hours (kWh) for EV applications. The C is a constant to convert from g/CO2e to metric tons of CO2 equivalent (MT CO2e). Also, an estimate of LCFS credit price must be assumed to calculate total revenue.

Carbon intensity is defined for each fuel technology with a well-to-wheel analysis of that fuel’s GHG emissions. The CI value for diesel is the benchmark that declines over time, forcing petroleum producers to reduce CI or buy credits.

Next, a fleet must estimate the annual electric kWh used for vehicle charging. Fleets can work with vehicle OEMs, or a consultant such as GNA, to model the route and estimate energy consumption. Or to further improve accuracy, they can collect actual energy use data from a demonstration unit.

While obtaining a more accurate estimate produces the best results, there are coarse estimates for kWh/mile and kWh/hour that can give rough approximations to calculate annual electrical consumption. For a Class 8 truck, this value falls between 1.7 and 3.0 kWh/mi based on GNA’s recent experience in the California market. Multiplying the known truck miles per year by a kWh/mi value will yield an estimate for annual kWh.

To bring this all together, take the LCFS earning potential snapshot of a class 8 truck from earlier in the article. This formula uses the current July 2020 values of CI, EER, and C constants from the LCFS regulation, as well as assumes an LCFS market price of $196/credit, which was the 2019 average.

A class 8 truck travelling 60,000 miles per year, combined with the energy consumption estimate of 2.1 kWh/mi, and the LCFS credit formula using a 5.0 EER—you get an estimated $33,900 in revenue annually. With renewable electricity, the same Class 8 truck has the potential to earn $41,300 annually, a 22% increase.

Work with GNA to Get an Accurate Value

Educating fleets on the additional revenue potential through LCFS is a significant sales tool for OEMs and dealers. While the rough estimate here shows the value of LCFS, to show the program’s true potential to customers you will want to determine accurate annual energy consumption based on fleet operations. GNA provides a full range of LCFS services for electric vehicles from kWh estimation all the way to credit generation/monetization. Learn more here about GNA’s full service LCFS support program.

To learn more about how to leverage LCFS to increase EV sales, join GNA and ACT News on a webinar Wednesday, June 24 at 10 am PT. The hour-long webinar will include a breakdown of the LCFS program from a GNA expert, and a discussion from Daimler Trucks North America on how they use LCFS as part of their sales strategy. CLICK HERE to register.