Regional haul trucking and electric trucks go hand in hand. The relatively short haul and return-to-base nature of regional haul meshes well with the range of batteries currently available for use on battery-electric trucks.

Much of the electric truck deployment has taken place in California, but as battery technology continues to improve and as more states are looking to zero-emissions futures, it becomes more likely that the future of trucking will be battery-based. Interested stakeholders across North America are looking for guidance in prioritizing other regions where the deployment of battery electric vehicles makes sense.

Regional haul meshes well with the range of batteries currently available for use on battery-electric trucks.

Long-term the future of trucking is electric, that is certain. What is not as certain is which sorts of operations and geographies are best suited for electric trucks in the short-term. We do know that relatively short routes are well-suited to the range of electric trucks currently on the market, and return-to-base operations make charging infrastructure development — which is frequently cited as one of the top barriers to electric truck adoption — relatively straightforward.

To help the industry figure out where the trucks would be most beneficial in the short term, the North American Council for Freight Efficiency and Rocky Mountain Institute published The High-Potential Regions For Electric Truck Deployments report.

In order to determine which regions were ripe for electric truck deployment, a three-part framework was developed. The framework looked at:

- Technology – Identify the regions that are most favorable to the unique attributes of the technology itself.

- Need – Identify the regions that exhibit the greatest need for the technology.

- Support – Identify the regions that provide the most support for the technology.

The report, High-Potential Regions for Electric Truck Deployments, determines regions best suited for near-term EV truck deployment.

The technology piece involved range (including climate), electricity pricing and regenerative braking. The average range of battery electric trucks that should be in the market in the next few years is 286 miles/460 kilometers. This range is expected for vehicles operating in ideal conditions close to 70° F. Vehicles operating in significantly colder or warmer climates may see a reduction in range due to reduced battery performance. One of the biggest selling points for electric vehicles is how much cheaper and less volatile electricity prices are compared to diesel. However, pricing varies by region and by utility.

The need piece included air quality and environmental justice, greenhouse gas emissions and freight flows. Fleets should prioritize deployments in air quality nonattainment areas. It is important to note that historically disadvantaged communities are more likely to be located near truck-traffic corridors and therefore subjected to more toxic emissions. Switching to electric vehicles would reduce pollution in these disadvantaged communities. Electric trucks also will significantly reduce (and eventually eliminate) greenhouse gas emissions when compared to diesel trucks. While electric trucks do not have tailpipe emissions, they do still generate emissions at the power plant used to generate electricity — though the electricity grid is getting cleaner every day as well.

Fleets also should consider both the current and expected level of freight that will flow through a given area and should prioritize regions with high levels of freight.

A framework was developed that looked at technology, need, and support.

The support piece included state, province, and city policies and incentives, utility programs and rates, and expressed interest in this electric transition, foreshadowing supportive policies and incentives to come. More states, provinces, and cities are considering zero emissions vehicle mandates, but states and provinces also are offering incentives to help bring down the total cost of ownership of electric vehicles. In addition, utility company funding is available to help reduce costs associated with charging infrastructure. One last item considered under the support leg of the framework (though not included in the analysis) was the ability to find trained staff to drive, manage, and service electric trucks.

The areas where the three criteria of the framework came together were considered hot spots for near-term regional haul electric truck deployment. This framework will be especially valuable for:

- Fleets with geographically dispersed operations trying to determine where to prioritize electric trucks;

- Utilities trying to understand the diverse considerations surrounding electric trucks; and

- Policymakers looking to encourage more freight vehicle electrification.

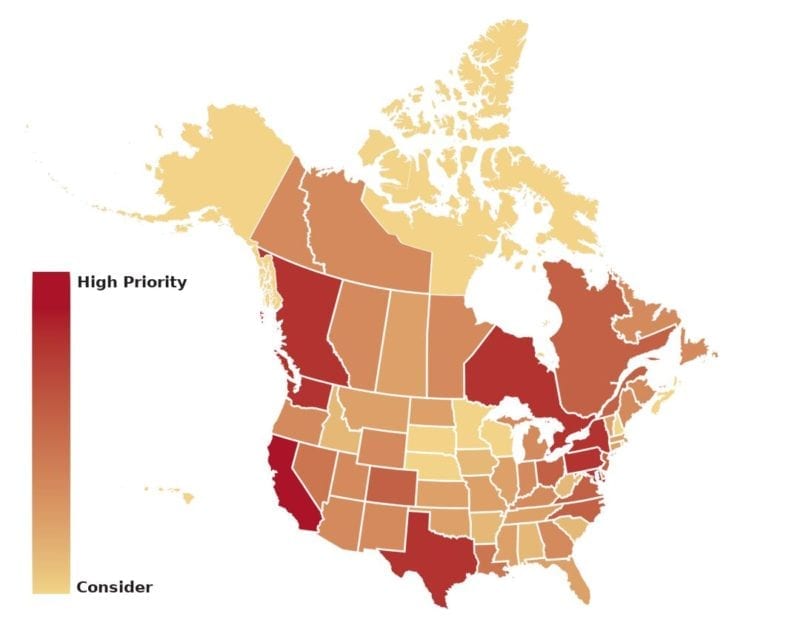

Regions favorable for electric truck deployments are found across North America. The regions with the highest potential for electric truck deployments include:

- Northern California

- Southern California

- The Texas Triangle

- Cascadia (stretching from Portland, Oregon through Seattle and into Vancouver, Canada)

- Colorado Front Range

- Northeast United States

- Greater Toronto Area

- Greater Montreal

It should be noted that many trucking operations are not confined to individual states or provinces, and therefore, fleets should think about electric vehicle deployments at the regional level. The most important factor for geographic considerations is where the truck plans to charge, as this impacts electricity pricing and access to incentives.

Policies and incentives to support electric truck adoption vary dramatically by region, with some jurisdictions committing significant budgets to robust incentive programs while others have done little or nothing to support electric truck adoption.

Policymakers and advocates looking to increase adoption of electric medium- and heavy-duty vehicles in their regions should focus on the framework criteria they can change. A region’s climate or topography cannot be changed, but things like vehicle incentives, charging infrastructure, and utility rate structures can be influenced and changed.

It is going to take collaboration by fleets, policymakers, regulators, utilities, and other stakeholders in their region to develop the best strategies to advance electric truck deployment.

Fleet owners with trucks operating regional haul routes of approximately 230 miles/370 kilometers or less per shift or day in these high-priority regions should begin developing plans for electric truck deployment today.

Of course, market forces will play a role in where and how quickly electric trucks are on the road. As these trucks start delivering an observed positive return on investment, demand among fleets will rise. In many cases, electric trucks already make economic sense, especially when paired with incentives. In fact, between “hard costs” — purchase price, maintenance expenses, and electricity prices — and “soft costs”— driver attraction and retention and environmental branding — total cost of ownership of electric trucks can be on par with or even cheaper than diesel vehicles.

It is likely that regional haul applications will account for a majority of the heavy-duty battery electric truck sales over the next decade, which are estimated to be as high as 13% in the U.S.

In order for electric trucks to become a significant part of the regional haul market, fleets need to begin collecting real-world data about them and learn lessons from their initial deployment, which will allow them to further refine the framework and analysis described above and ensure that electric trucks — wherever they’re deployed — are successful.