Last summer, staff at the California Air Resources Board (ARB) drafted a proposal to disqualify natural gas vehicles (NGVs) from one of the state’s most popular advanced, clean transportation technology funding programs. The Heavy-Duty Vehicle Incentive Program, or HVIP, is preferred by fleets transitioning to cleaner technology because it offers vouchers at the point of sale, providing both the buyer and the seller with certainty and immediate compensation for the premium so often associated with near-zero and zero tailpipe emission vehicles.

Implementing an RNG Compromise

Many were upset by the ARB’s proposed move. Supporters of near-zero emission NGVs fueled by renewable natural gas (RNG) opposed the air agency’s modification. After several months of back-and-forth, the two parties eventually reached an arrangement. The accommodation limited future HVIP funding to natural gas fueled heavy-duty vehicles equipped with an 11.9L low NOx engine.

The compromise added an additional requirement— in order to qualify for HVIP funding, the new NGV applying for funding must also be fueled with RNG produced within the state of California.

In order to qualify for HVIP funding, the new NGV applying must also be fueled with RNG produced within the state of California.

An Unprecedented Requirement

The idea that vehicles funded by California public resources should also be powered by fuel that originates in California may have made sense to some. Setting aside the fact that no such prerequisite exists for any other clean transportation technology subsidized by the state, encouraging the capture and beneficial reuse of fugitive methane would help California meet its Short Lived Climate Pollutant (SLCP) goals, as required by SB 1383 (Lara, 2016). However, the real challenge presented by this new, unprecedented requirement was, at the time this understanding was reached, neither the ARB nor the NGV/RNG industries had any sense of the current or future supply of California-produced RNG.

When this additional constraint was placed on future NGVs applying for HVIP funding, no one knew how much in-state RNG was being produced in California. Nor was it known when new supplies would be coming online or how much California RNG would be available in the future. Without better data on the in-state supply of RNG, it was not possible for ARB or the industry to know if HVIP applicants would even be able to comply with this new requirement. Many observers were baffled by the agency’s lack of understanding of the market’s ability to meet this extra condition, especially given how much effort the ARB usually puts into ensuring stakeholders can meet its other program requirements.

Theoretical Versus Actual Production

Many of the NGV industry’s most prominent players were concerned. Most existing studies of future California RNG supply, they realized, have focused on theoretical potential production—not what was actually available. Previously, researchers had looked at the availability of organic feedstocks that could be used for local RNG production. Using projections of the volume of raw materials, they estimated the amount of gas that could hypothetically be produced. Their models focused on variables such as the gross, technically, or economically available resource bases. Although useful, none of these projections tried to tally what was actually being built to produce RNG in-state.

Most existing studies of future California RNG supply have focused on potential production—not what was actually available.

To address this gap in data, GNA performed a study to provide stakeholders and policy makers with a much more accurate, data-driven estimate for the total volume of RNG that will be produced in-state and made available to California fleet operators in the near term. By using data provided by state and local agencies, project developers, third party marketers, and other reliable sources, this inventory assesses the actual RNG production of existing facilities and aggregates the projected supply coming from developing projects.

It provides a reliable estimate of the actual supply of in-state RNG that was produced on January 1, 2020, the quarter by quarter production growth that will take place over the next four years, and the total supply of in-state RNG that will be flowing to end users in California on January 1, 2024.

This inventory assesses the actual RNG production of existing facilities and aggregates the projected supply.

Determining California’s Actual RNG Supply

This research determined that, at the end of 2019 when the ARB’s new policy went into effect, a handful of California producers were only delivering about 2.7% of the total RNG that was being consumed by the state’s NGVs—or slightly less than 3.8 million diesel gallon equivalents (DGE). It wasn’t much, particularly considering that total California RNG consumption in 2019 was 139.2 million DGE, or 77.4% of the 179.9 million DGE of natural gas fueling the state’s NGVs.

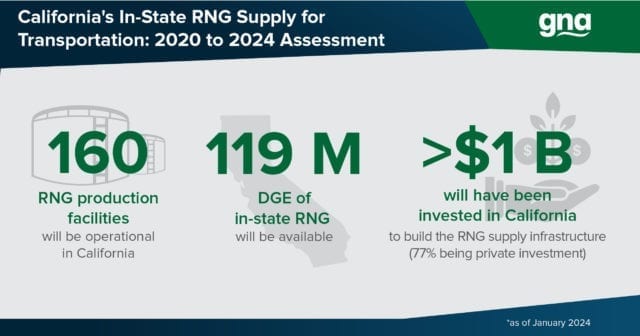

Fortunately, the assessment found that there is phenomenal growth currently taking place in California’s RNG production, with much of this new renewable fuel going to transportation. By January 1, 2024, more than $1 billion will be invested in 160 California-based RNG production facilities that will be supplying nearly 119 million DGE to transportation end users annually.

By January 1, 2024, more than $1 billion will be invested in 160 California-based RNG production facilities.

As a significant proportion of the growth in “domestic” production will come from California dairies, the energy weighted Carbon Intensity (CI) value of the in-state supply of RNG will be approximately -101.74 gCO2e/MJ. At that negative carbon intensity, an average NGV fueled by California RNG will completely offset the GHG emissions of two diesel trucks!

The Potential of California’s RNG Supply

This new California RNG supply has the potential of delivering major environmental benefits to the state. Assuming all 119 million DGE of California RNG went to fuel Model Year (MY) 2020 near zero emission (NZE) natural gas trucks, replacing the use of MY 2020 diesel trucks, the annual emission reductions would be 3.4 million tons of greenhouse gases (GHGs), nearly 1,400 tons of NOx, and 8.6 tons of toxic diesel particulates!

This new California RNG supply has the potential of delivering major environmental benefits to the state.

If California were to adopt policies to encourage the purchase and deployment of new NZE NGVs to consume this supply of California-derived, carbon negative, diesel-displacing clean fuel, the environmental benefits would be off the charts. Adjusted for Energy Economy Rating (EER), 119 million DGE would be sufficient to fuel 13,731 natural gas trucks annually. If the HVIP provided a $45,000 voucher toward the purchase of each of these new NZE heavy-duty natural gas trucks, it would cost the state $618 million. Assuming a fifteen-year life for these vehicles, they would generate 51.4 million metric tonnes of CO2e and 20.8 thousand tons of NOx reductions, at a cost of $12.03/MT of CO2e and $29,702 per ton of NOx.

For comparison, ARB staff estimate that the cost effectiveness of the typical HVIP incentive ($150,000) for a battery electric truck of comparable size is $545/MT of CO2e and $299,000 per ton of NOx.

Continued Growth Expected

This California RNG supply estimate represents a snapshot in time. It only included those projects that exist or are currently in development and met this study’s criteria for inclusion as of July 2020. The supply estimate also does not include the dozens of carbon negative RNG production facilities that are currently being built outside of the state which will also deliver clean fuel to California end users.

In fact, the results of the study likely underestimate what the supply of locally produced RNG will be three and a half years from now. Given the accelerated pace of new RNG production in-state, the additional 15 – 20 new dairy digester projects the California Department of Food and Agriculture (CDFA) will soon announce funding for, and the impacts of new regulations such as CalRecycle’s SB 1383 organics recycling and procurement requirements, California’s actual RNG supply will likely be higher than the study estimates.

Given the pace of new RNG production in-state and new regulations, California’s actual RNG supply will likely be higher than the study estimates.

Now that the NGV industry and policy makers have a better understanding of the future supply of in-state RNG and the cost-effectiveness of the environmental benefits it could deliver, the question is what will they do with the information? Given the economic devastation of the coronavirus pandemic, now more than ever it is incumbent on public officials to spend scarce state resources efficiently. Now, more than ever, with funding stretched so thin, it is imperative we maximize the bang for our buck. Taking advantage of California’s ample RNG supply, deploying more NZE NGVs on the road, and reducing tailpipe emissions today is the most prudent course of action.