The Advanced Transportation Investor Summit served up investment trends in the fleet market with an unmatched convening of experienced investors, entrepreneurs, and buyers on September 15 and 17. As part of Advanced Clean Transportation (ACT) Virtual, a 4-month online education series on the latest vehicle technology and fueling infrastructure innovations, successful investors and entrepreneurs shared their secrets to growth in the challenging fleet market.

ACT Virtual Module 3 brought together over 1,000 attendees, who heard first-hand how investment is pouring into advanced transportation technology firms at an accelerated rate – from private firms to government funding. Industry insiders gave insight into what they are betting big on for the road ahead, how emerging technologies have achieved mass-market scale, and what investment looks like in a post-pandemic world.

Highlights include how VCs, entrepreneurs and government are jumpstarting the market to build the advanced, clean fleet market. A thought-provoking discussion on how to scale innovative solutions and technologies from R&D to mass-market penetration wrapped up Module 3.

Episode 1 Highlights: Tuesday, September 15, 2020

Episode sponsored by: Shell and Meritor

Keynote Remarks: Jay Craig, CEO and President of Meritor

The Summit featured an opening keynote address on September 15 by Jay Craig, CEO and president of Meritor, an ACT Virtual sponsor and a leading global supplier of drivetrain, mobility, braking and aftermarket solutions for commercial vehicles.

Craig gave an overview of how an established industry leader structures a strategic investment portfolio to support future growth based on the rapidly changing technology from Meritor’s 110-year-plus legacy of bringing innovative products to the market. Craig said that big commitments to electric vehicles by very large fleets are, “Pulling both us and our customers to produce electric vehicles at a very rapid pace.” An evolving regulatory environment, plummeting battery prices, and growing charging infrastructure are further accelerating the trend, according to Craig. He concluded by stating that the trend creates opportunity and an expectation to lead in electric drivetrain technology globally for Meritor.

Executive Panel: Jumpstarting the Market – VCs, Government, and Entrepreneurs Building the Advanced, Clean Fleet Market

Commissioner Patty Monahan, California Energy Commission; Brook Porter, Partner, G2VP; Alden Woodrow, Co-founder and Chief Executive Officer, Ike; Sam Gabbita, Ventures Director, Climate Investments (Moderator)

The keynote was followed by an executive panel of investors, entrepreneurs, and government discussing the state and outlook of early-stage investment in advanced transportation technologies. The panelists agreed that investment is pouring into advanced transportation technology firms at an accelerated rate—from private capital to government funding. These investments span multiple technology types including electric vehicles but also hydrogen vehicles and autonomous vehicles. Several highlights include:

- Investors see the productivity, efficiency, and performance benefits of artificial intelligence and autonomous vehicles

- Public agencies see the health and air quality benefits from efficiency and clean technology

- Fleets and OEMs see the need to support early stage companies with investment, know-how, and ready-made markets

Panelists agreed electric vehicles are accelerating due to technological improvements, early adopters, and benefits of scale.

All panelists agreed that electric vehicles are accelerating due to a virtuous cycle of technological improvements, early adopter fleet segments, and benefits of scale from the light duty market. Panelists had doubts about the long-term investment potential of natural gas, captured when Commissioner Monahan said, “I would say for the long term, we’re not seeing huge global investment in natural gas vehicles, it’s in pockets. So how are you going to drive down cost?” As for hydrogen, panelists agreed that it may eventually prove itself over time but, according to Porter, “The economics have been so much more challenging. You don’t have the early applications like you do in EVs that can drive the market.”

Episode 2 Highlights: Thursday, September 17, 2020

Episode sponsored by: Shell, Meritor, ChargePoint

Executive Panel: Scaling to Success – The Financial Leap to Mass Deployments in the Advanced, Clean Fleet Market Panel

Morgan Andreae, Executive Director of the Growth Office, Cummins Inc.; Chris Haffenreffer, Assistant Vice President of Innovation, Enterprise Holdings; Mary Nichols, Chair, California Air Resources Board; Pasquale Romano, Chief Executive Officer, ChargePoint; Matt McLelland, Innovation Strategist, Covenant Transport

Market-making fleets, OEMS, and government leaders kicked off the second episode on how innovative technologies reach scale. Panelists explained that such leaps involve significant financial capital and a ripe regulatory environment as well as significant end-user investment of resources into the technology. In a wide-ranging conversation that covered the early scaling of consumer-focused startups who have pivoted into the fleet market, the scandals surrounding hydrogen fuel cell startup Nikola that broke the week before, and increased demand by fleet customers for sustainability, highlights included:

- Investment in the fleets market is a long-term play that requires making investments well before the market has matured

- Overselling a technology, without first ensuring it delivers consistent positive benefits and reliability for early customers, is a poison pill in the fleet market

- Constant engagement with various stakeholders, including startups, investors, and government ensures companies understand new innovations and upcoming market transformations

Innovative technologies reach scale with significant financial capital and a ripe regulatory environment.

A theme emerged across the discussion that investors and entrepreneurs in the advanced transportation market must constantly look ahead while nurturing today’s opportunities to reach scale.

“We look around at what’s there at a demonstration level and ask, ‘How long would this take to scale’? That involves looking hard and looking often at how things are developing,” said Chair Nichols. Innovators must take a similar tack, and in many cases be the first to spot a trend while convincing others of its potential. Romano added, “If you’re going to get disrupted, you need to look 10 years out and you have to start spending.” Missing that opportunity can spell peril for incumbents, according to Romano.

Keynote Remarks: Michael Linse, Founder & Managing Director, Linse Capital

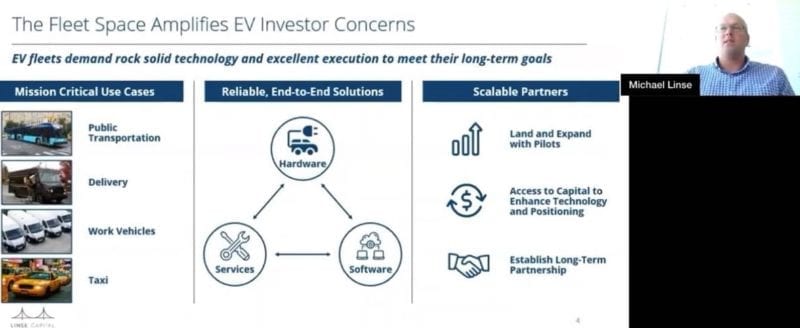

Linse gave a closing keynote on the challenges of investing in the fleet market. Linse’s growth equity investment firm has invested in several late stage transportation-focused companies including ChargePoint, Redaptive, Skydio, and Valens.

Most electric vehicles and electric vehicle charging startups have failed, stated Mr. Linse. “Servicing these vehicles is not trivial and if you have a reliability issue, it can kill you. It’s also why traditional venture capital has historically shied away from the space,” said Linse. According to Linse, the demands of the fleet market are especially punishing for poorly conceived and serviced products. “In the consumer market, you can put out a minimum viable product and customers will forgive you if reliability isn’t perfect… You cannot do this in the fleet space where vehicles are mission critical to the daily operations of the company.”

Secure Your Ticket

ACT Virtual attendees can participate in 5 different advanced transportation “modules” that each feature multiple days of programming. With several more educational episodes planned through November 19, there is still time to secure a ticket at www.act-virtual.com.