There’s no disputing it, 10 MPG is a realistic achievement for commercial vehicles carrying real loads in the real world.

That was the main finding from our Run on Less cross country roadshow in which seven drivers in seven trucks drove more than 50,000 miles over the course of 17 days (99 truck days) and achieved on average 10.1 MPG. In fact, four truck days were between 12.5 and 13.0 MPG.

One of the things we learned during the Run is that there is no one answer to cracking fuel efficiency but we discovered 10 actions fleets can take to achieve 10+ MPG.

1. Build a culture of methodically choosing technologies

2. Keep equipment well maintained

3. Implement the right axle configuration

4. Provide tools to reduce idle time

5. Educate and incent conscientious drivers

6. Buy all available tractor aerodynamics

7. Optimize cruise control and vehicle speed

8. Use downsped powertrains and AMTs

9. Embrace low rolling resistance tires

10. Adopt appropriate trailer aerodynamics

Since our inception we’ve been committed to helping the nation’s fleets improve their freight efficiency with commercially available technologies. To that end we have completed 16 Confidence Reports covering 85 technologies and practices, and conducted 20 workshops to share, and at time debate, our findings. Next to publish will be one on Solar on Tractors and Trailers.

Since Run on Less we have decided to expand our scope. We are going to continue to bring our unbiased analysis of currently available fuel saving technologies and practices to the industry, but we are now expanding into emerging technologies. Our hope it to bring clarity into the emerging trucking technology space.

And we could not think of a better place to start than with electric trucks. No subject is more fraught with confusion than commercial battery electric vehicles and changes and developments in this space are happening at a rapid pace.

For the past six months Rick Mihelic has been leading a team gathering information, conducting interview and analyzing data to unmuddy the waters when it comes to commercial battery electric trucks.

NACFE just issued its first ever Guidance Report: Electric Trucks — Where They Make Sense to provide perspective, insight and resources on the complex topic of the viability of battery electric commercial class 3 thorugh 8 vehicles.

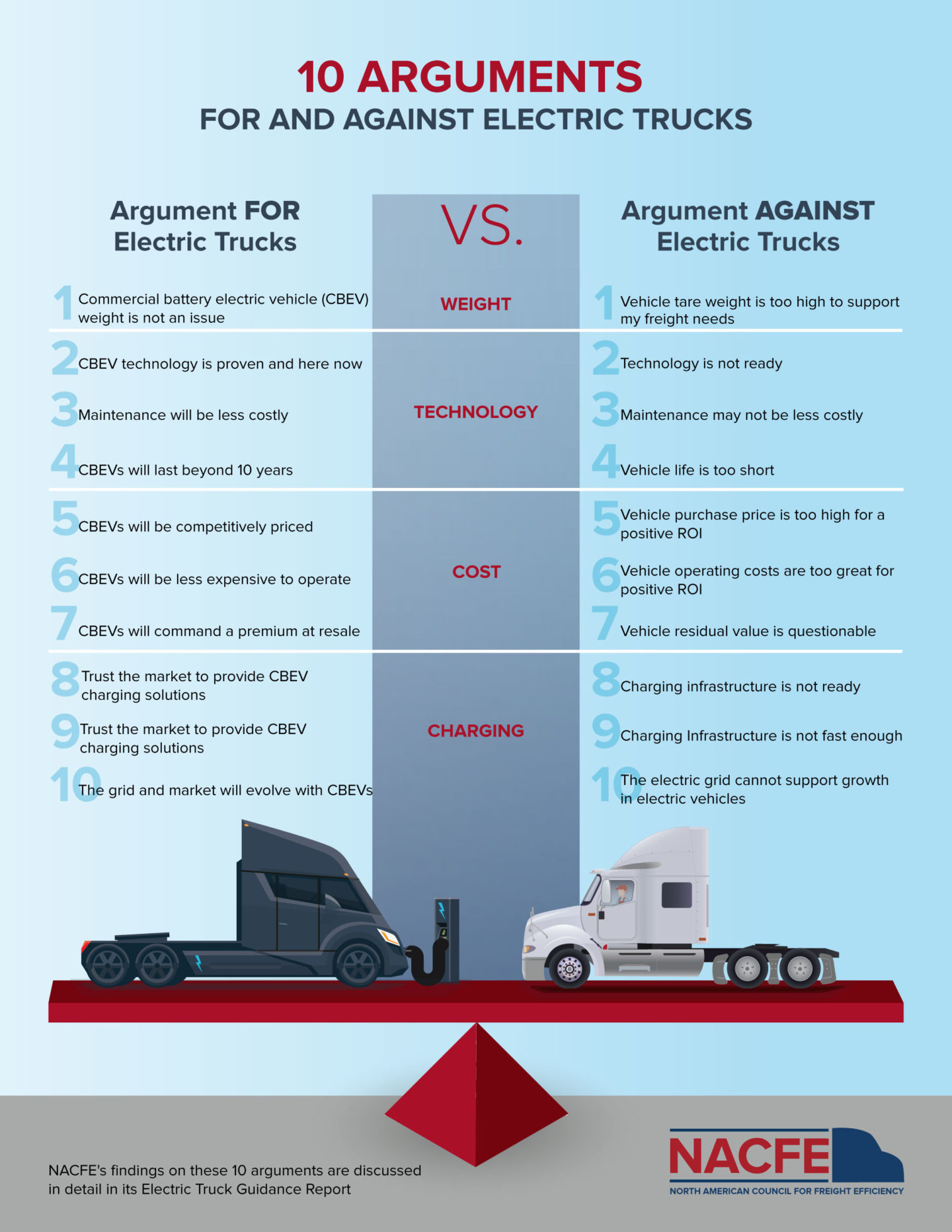

We identified some common arguments both for and against electric Class 3 through 8 commercial vehicles. One thing is certain there are passionate people on both side of the electric truck continuum. The findings fell into several broad categories: weight, technology, cost and charging/electric grid.

More specifically here are the 10 common themes or arguments both for and against electric trucks.

- Vehicle tare weight is too high to support my freight needs vs. BEV weight is not an issue: Competitive vehicle tare weights are possible in all classes for many duty cycles. Diesel powertrains also include fluids, emissions systems, exhaust systems, cooling systems, mountings, etc. that in total represent a significant weight reduction when removed. Typical payloads in many applications are well below maximum GVWR. The combination of both of these factors allows for BEV solutions with equivalent freight carrying capacity in many applications, but not all.

- Technology is not ready vs. BEV technology is proven and here now: Multiple new companies are entering the U.S. market with models ranging from Class 3 to Class 8. Established OEMs have been developing prototypes for field testing in specific markets. Automotive and bus battery electric vehicles have been in production for years and advancing on their learning curves in real world use. Battery capacities are expected to increase with time, cost and weight to decrease. The technology is on the steep part of the development S-Curve, where big improvements are regularly expected.

- Charging infrastructure is not ready vs. trust the market to provide BEV charging solutions: Off-shift charging of vehicles is possible today with existing systems. The challenge is high speed charging. BEVs needing sub-30 minute charging speeds require high capacity production charging systems that today are only in the conceptual phase. Fleets with well-defined one-driver shift A-B-A, or A-B-C-A type routes, for example, are well positioned for have base depot charging. Even fleets with routes between hubs, if range is sufficient, could have charging at both ends of the trip. Fleets with variable routes and no guaranteed return trips, will need growth in remote charging capacity before considering replacing diesels with BEVs.

- Charging Infrastructure is not fast enough vs. trust the market to provide BEV charging solutions: The speed needed for charging depends on each fleet’s duty cycles and daily and weekly route scheduling. Fleets that require sub-30 minute charging will need practical commercial vehicle capable charging technology to catch up their needs.

- The electric grid cannot support growth in electric vehicles vs. the grid and market will evolve with BEVs: The market penetration rate of battery electric trucks will be on decade’s time scale. The U.S. has energy production capacity for significant volumes of electric trucks and cars. Adding vehicle charging stations to a warehouse or factory is like adding a new line; a process utilities regularly perform for commercial sites. High rate charging expected for any sub-30 minute charging of commercial vehicles, does create a significant demand on the grid. Alternatives to mitigate this through leveling and storage systems are being considered.

- Maintenance will be more costly vs. maintenance may be less costly: Automotive experience with BEVs suggests maintenance of production designs should be on par or better than equivalent ICE powertrains. Prototypes and pre-production models generally see high infant failure rates and are managed more intensely, so the experience there is not representative of production units in normal field use. Long warranty periods promised by BEV manufacturers may reduce fleet financial risks on maintenance projections for commercial BEVs, but warranties do not alter truck potential downtime impacts.

- Vehicle purchase price is too high for a positive ROI vs. BEVs will be competitively priced: Investment in BEVs may require quantifying the true total cost of ownership of both diesels and battery electric vehicles by including so-called intangible “soft costs,” liability costs, indirect costs and opportunity costs buried in overhead or ignored in traditional ROI calculations. Industry pricing of BEVs is still largely ill defined. Pricing experience is largely based on prototype and pre-production experience and estimation. There are many variables including grants, tax breaks and incentives and a largely unknown residual or salvage value. The industry is also developing alternatives to traditional purchasing or leasing. The trend over the last decade is expected to be continued large reductions in cost and significant gains in performance. Diesel performance, in contrast, is unlikely to yield large gains in performance with reduced costs.

- Vehicle operating costs are too great for positive ROI vs. BEVs will be less expensive to operate: Operating costs can be less for BEVs. The electric drives are more energy efficient than diesels. The reduction in diesel based friction sensitive mechanical systems such as pumps, valves, transmissions, and belts should reduce maintenance and servicing. The track record to date is mixed because much of the truck experience has been through first generation products in small numbers, and in prototypes. These early vehicles were expected to have higher failure rates.

- Vehicle residual value is questionable vs. BEVs will command a premium at resale: Introduction of electric vehicles has most of them still within their first owner’s use. The used electric vehicle is in its infancy. Residual value is a question. The value of electric motors and batteries in salvage may prove an advantage as they can be repurposed for non-vehicle uses and may have significant life left. Mechanical systems at the end of vehicle life require reconditioning which can reduce their net value in salvage.

- Vehicle life is too short vs. BEVs will last beyond 10 years: NACFE’s discussions with fleets, OEMs and suppliers is that they expect a Class 3 through 8 vehicle life of seven to 10 years before major refurbishing or salvage. With BEVs the battery packs are the most common concern expressed. The manufacturers expect the battery packs to be replaced when they reach 80% of their initial capacity. NACFE projected the frequency of recharging events based on automotive experience and determined that batteries will likely exceed the seven to 10 year vehicle life. The fleet’s specific duty cycles and environments need to be evaluated when researching BEV choices.

You can see the full Guidance Report: Electric Trucks — Where They Make Sense on the future technology page of our website at nacfe.org

The commercial battery electric vehicle space is continuously evolving with changes and developments happening almost on a daily basis. We plan to stay on top of those developments and have already assembled a team to begin exploring battery electric vehicles for medium-duty applications.

While we have added guiding emerging and future technologies to our workflow, we are not abandoning work on existing fuel efficiency technologies and will work on updating existing Confidence Reports as conditions warrant.

In the meantime, NACFE team members will be attending a variety of industry events this spring and summer and we look forward to meeting up with you to learn about your freight efficiency challenges and the things you are doing to make 10 MPG a reality for your fleet.